Input Tax Credit Set off (Sections 16 – 22)

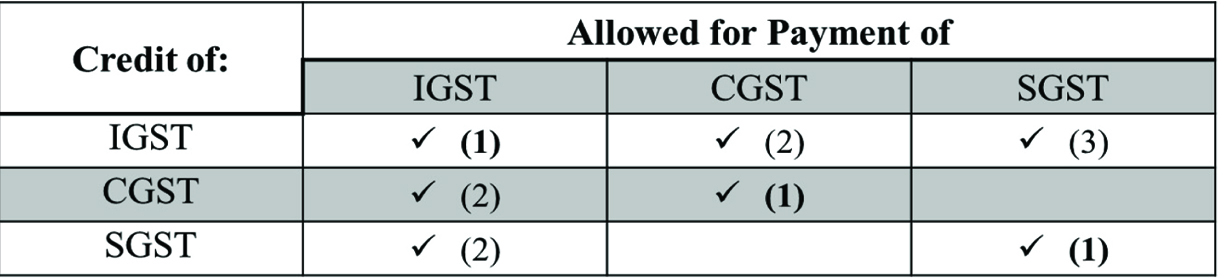

The input tax credit would be eligible for set off as under:

1. The CGST SGST and UTGST paid on supply of service to be set off against the

output CGST, SGST and UTGST respectively.

2. When an item is procured for resale, then credit of CGST and SGST/ UTGST is

available for all items.

3. When inputs and consumables are procured for the manufacture of goods on which

CGST/ SGST/ UTGST is paid, then credit of CGST and SGST/ UTGST is available

for all items.

4. SGST/ UTGST is allowed first to be utilised against SGST/ UTGST and then

IGST.

5. Similarly, CGST is allowed first to be utilised against CGST and then IGST.

6. IGST is allowed to be utilised for IGST, CGST and then SGST/ UTGST in this

sequential order.

The SGST/ UTGST is not allowed to be adjusted to the CGST and vice versa. This may

lead to accumulation of credit in some places.